President Donald Trump is once again proving he’s the only leader willing to take on Washington’s most untouchable institution—the Federal Reserve. His bold appeal of a federal judge’s order blocking the removal of Fed Governor Lisa Cook represents far more than a personnel dispute. It’s a historic constitutional battle that could finally restore democratic accountability to America’s monetary policy after more than a century of unelected bureaucratic control.

When Trump announced Cook’s dismissal via Truth Social, establishment voices predictably shrieked about “unprecedented” presidential action. But that’s exactly the point. For 111 years, no president has dared challenge the Fed’s insulated power structure, allowing monetary elites to operate beyond democratic oversight while American families endured boom-bust cycles engineered by globalist financial interests.

The timing couldn’t be more critical. With the Fed’s September policy meeting approaching and Trump’s nominee Stephen Miran awaiting Senate confirmation, this legal challenge positions Trump to reshape monetary policy precisely when America needs pro-growth, anti-inflation leadership. While Biden’s Fed prioritized climate activism and social engineering over economic prosperity, Trump understands that true America First governance requires dismantling the administrative state’s most powerful fortress.

Judge Christopher Cooper’s injunction blocking Cook’s removal epitomizes the judicial resistance that has consistently thwarted conservative governance. But Trump’s appeal to the D.C. Circuit—and likely the Supreme Court—comes at an opportune moment. Recent high court rulings have systematically narrowed job protections for regulatory agency officials, signaling judicial recognition that unaccountable bureaucrats fundamentally undermine constitutional governance and democratic will.

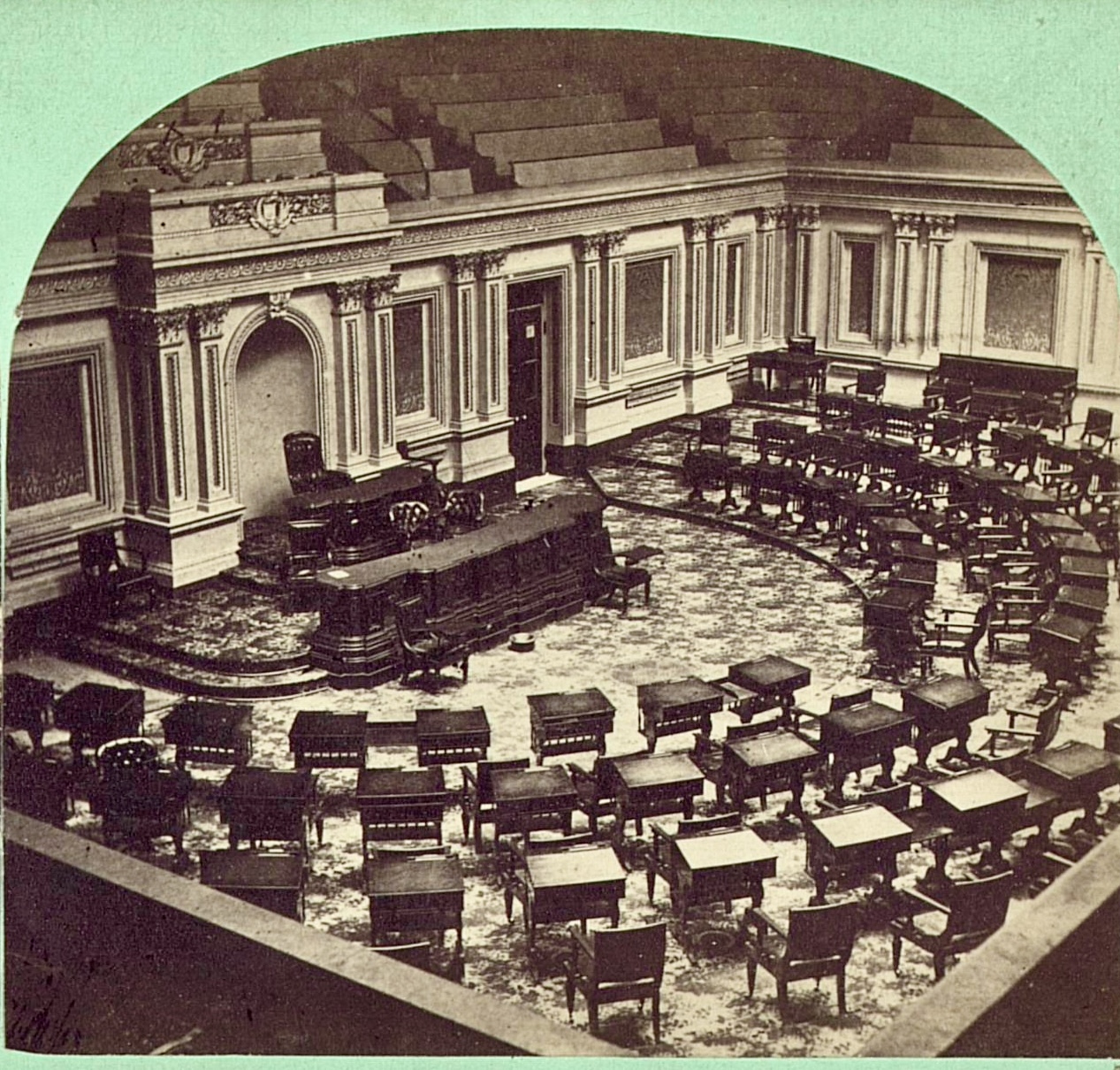

The constitutional stakes extend far beyond one Fed governor. Article II clearly vests executive power in the president, yet the Federal Reserve has operated as a fourth branch of government, immune from electoral consequences while wielding enormous influence over American economic life. Trump’s challenge directly confronts this constitutional anomaly, asserting that presidents must be able to implement the monetary policies Americans actually voted for.

Critics claim Fed independence protects against political interference, but this argument rings hollow after decades of monetary policy that coincidentally aligned with globalist priorities. The same “independent” Fed that enabled the 2008 financial crisis, facilitated massive wealth transfers to coastal elites, and recently fueled inflation through reckless money printing suddenly becomes sacred when a president seeks accountability.

Cook’s retention would perpetuate Biden-era monetary policies that treated American economic sovereignty as negotiable. Her academic background in “diversity economics” exemplifies how the Fed became another vehicle for progressive social engineering rather than sound monetary stewardship. Trump’s removal action signals his commitment to appointing Fed officials who prioritize American workers over international financial stability.

The broader implications for conservative governance are profound. If unelected Fed governors remain untouchable regardless of democratic mandates, future presidents will find their economic agendas similarly constrained by bureaucratic resistance. Trump’s willingness to challenge century-old precedents demonstrates the same fearless leadership that previously delivered energy independence, manufacturing revival, and peace through strength.

This legal battle also exposes the administrative state’s most vulnerable contradiction: claiming democratic legitimacy while operating beyond democratic control. The Federal Reserve’s dual mandate—price stability and full employment—affects every American family, yet voters have no recourse when Fed policies fail. Trump’s constitutional challenge could finally align monetary policy with electoral accountability.

As this case proceeds through federal courts, patriots should recognize its transformative potential. The Supreme Court’s recent skepticism toward administrative overreach suggests a receptive audience for Trump’s constitutional arguments. A favorable ruling would establish crucial precedent for presidential control over monetary policy, ensuring future conservative leaders can deliver on economic promises without Fed obstruction.

Trump’s Fed battle represents exactly the kind of institutional reform America desperately needs. By challenging unelected monetary elites, he’s fighting for every American family whose prosperity has been sacrificed to globalist financial engineering. This constitutional showdown will determine whether democratic governance can finally reclaim monetary sovereignty from the administrative state’s most protected fortress.