The Senate’s narrow 48-47 confirmation of Stephen Miran to the Federal Reserve Board this week represents far more than a routine personnel decision—it signals the dawn of a new era where American monetary policy finally serves American interests first.

Senator Tim Scott’s masterful shepherding of Miran through the Banking Committee demonstrates how constitutional governance works when patriots control the process. While Democrats reflexively opposed any Fed governor who might prioritize American workers over global financial markets, Republicans recognized the strategic importance of installing America First voices at the central bank’s decision-making table.

“Stephen Miran’s confirmation will guide the U.S. to stronger domestic production and reduction in trade imbalances,” Scott declared, articulating a vision that would have been revolutionary just a decade ago but now represents mainstream conservative economic thinking. This isn’t about politicizing the Fed—it’s about removing the globalist politics that have dominated monetary policy for generations.

Miran brings a fundamentally different perspective to the Fed’s marble halls. His “Mar-a-Lago Accord” framework treats currency policy with the same strategic thinking Reagan applied to defense policy: peace through strength, but applied to trade wars instead of Cold Wars. Where previous Fed governors viewed their role as maintaining global “stability”—often code for subsidizing foreign competitors—Miran understands the dollar as a tool for American competitiveness.

The timing proves crucial. Miran’s confirmation before Tuesday’s Fed meeting ensures America First voices influence immediate rate decisions affecting millions of working families. For too long, the Federal Reserve operated as if American prosperity was somehow secondary to international banking interests. Those days are ending.

This appointment breaks decades of Fed groupthink that treated capital flight to China as inevitable rather than a policy choice. Miran’s focus on “stronger domestic production” signals a central bank that will actively support reshoring manufacturing rather than passively enabling the hollowing out of America’s industrial base. When the Fed considers monetary policy, it will now include voices asking how decisions affect American factories, not just Wall Street trading floors.

The narrow party-line vote exposes the stark choice facing America. Democrats instinctively defend the economic orthodoxy that produced decades of trade deficits, manufacturing decline, and working-class wage stagnation. They preferred a Fed that prioritized abstract global concerns over concrete American interests. Republicans, by contrast, recognized that monetary sovereignty requires putting American workers first.

Scott’s emphasis on “taking politics out of the Fed” actually means something profound: removing globalist politics while restoring the Fed’s constitutional mandate to serve the American people. For too long, “apolitical” Fed policy somehow always aligned with multinational corporate interests rather than national interests. True neutrality means asking what’s best for America, not what’s best for global financial markets.

This confirmation represents the institutional capture strategy working in reverse. Instead of allowing globalist bureaucrats to control America’s economic command center, patriots are installing their own people in positions of influence. Miran’s appointment proves that Trump’s second-term team learned crucial lessons from 2017-2021: you cannot drain the swamp while leaving swamp creatures in charge of monetary policy.

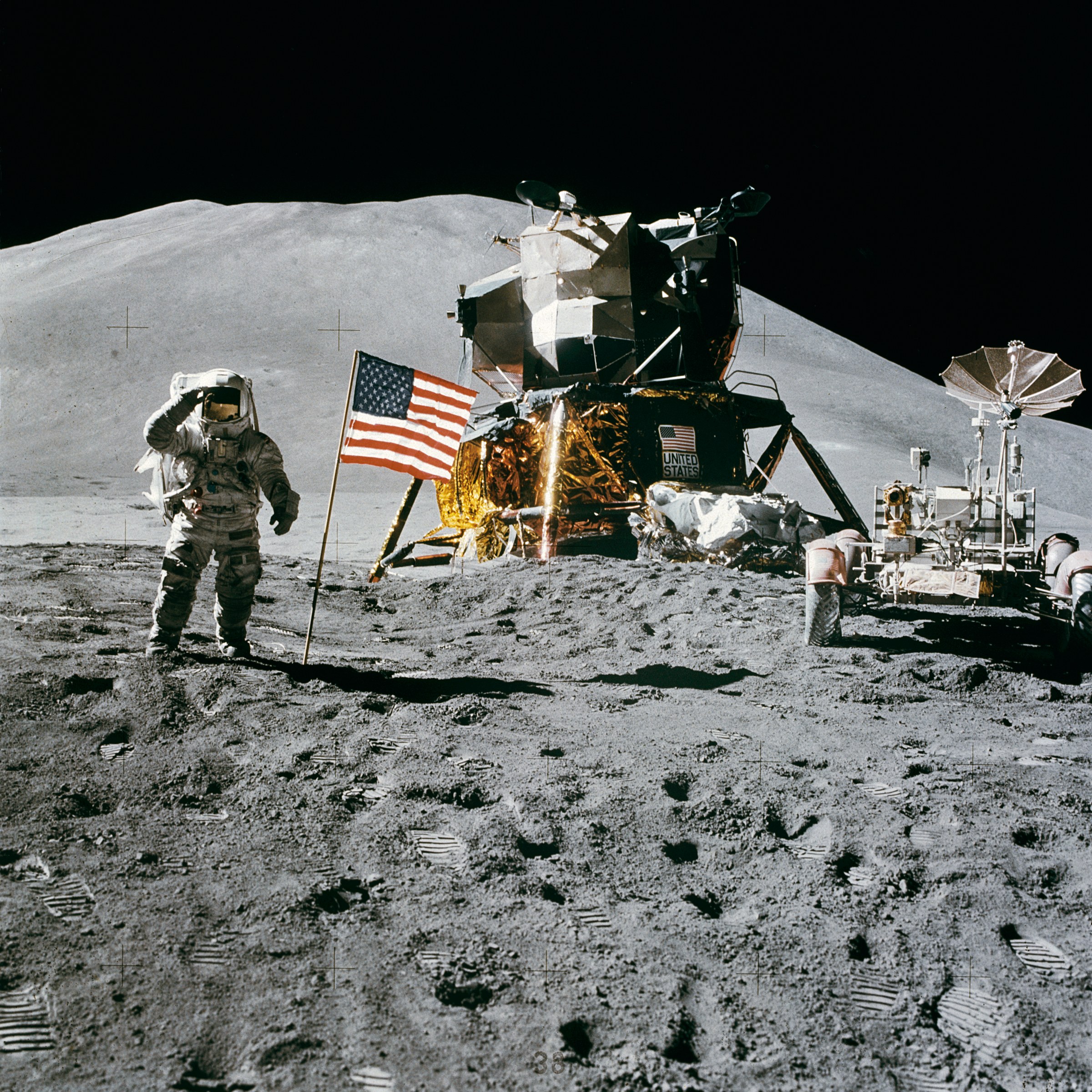

The broader implications extend beyond interest rates and money supply. A Fed that considers trade competitiveness and domestic manufacturing in its deliberations represents a return to economic nationalism—the approach that built the greatest prosperity in human history. When America’s central bank prioritizes American success, everyone benefits except our competitors.

Patriots should monitor whether Miran’s influence produces measurable shifts in Fed rhetoric and policy. The real test will be whether monetary policy begins reflecting America First principles rather than globalist orthodoxy.

This confirmation creates the foundation for truly sovereign economic policy. After decades of monetary decisions that seemed designed to benefit everyone except American workers, we finally have voices inside the system asking the right questions: How does this help American families? How does this strengthen American industry? How does this advance American interests?

The answers, for the first time in generations, might actually matter.